29+ 15 year mortgage amortization

Bankrates mortgage amortization calculator shows how even a 01 percent difference on your. The annual volume of HECM loans topped 112000 representing a 1300 increase in six years.

29 Amortization Schedule Templates Free Premium Templates

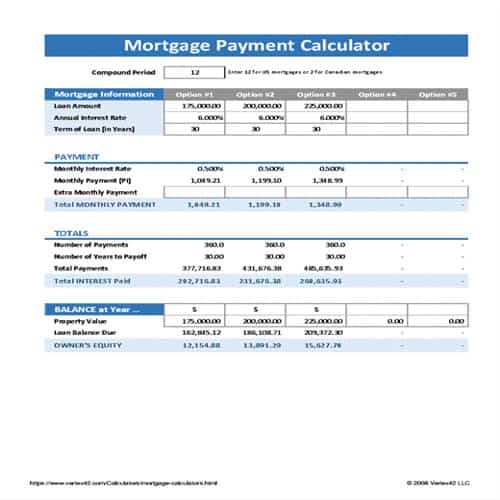

The following table lists historical mortgage rates for 30-year mortgages 15-year mortgages and 51 ARM loans.

. The average 15-year fixed mortgage rate is 5190 with an APR of 5220. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. 30 Year Fixed 15 Year Fixed 30 Year FHA 30 Year Jumbo 51 ARM 30 Year VA 30 Year Jumbo Mortgage Rates Average 30 year fixed JUMBO mortgage rates from Mortgage News Daily and MBA.

You will spend on principal on interest. With a 15-year fixed loan the locked interest rate keeps payments in a traditional amortizing schedule. To learn more about 15-year fixed mortgages read on below.

You will spend on principal 48426 on interest. A reverse mortgage is a mortgage loan. As of 2021 TD has over 25000 employees making it the second-largest bank in Canada.

Youll wind up paying more in interest over the life of a 30-year mortgage than a 15- or 20-year. Year 1 Month 5. Mortgage amortization schedule for year 15 2036.

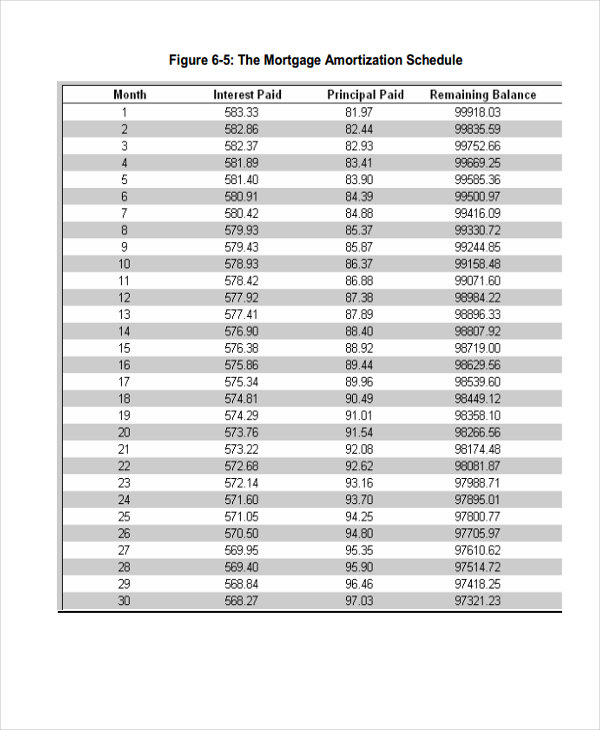

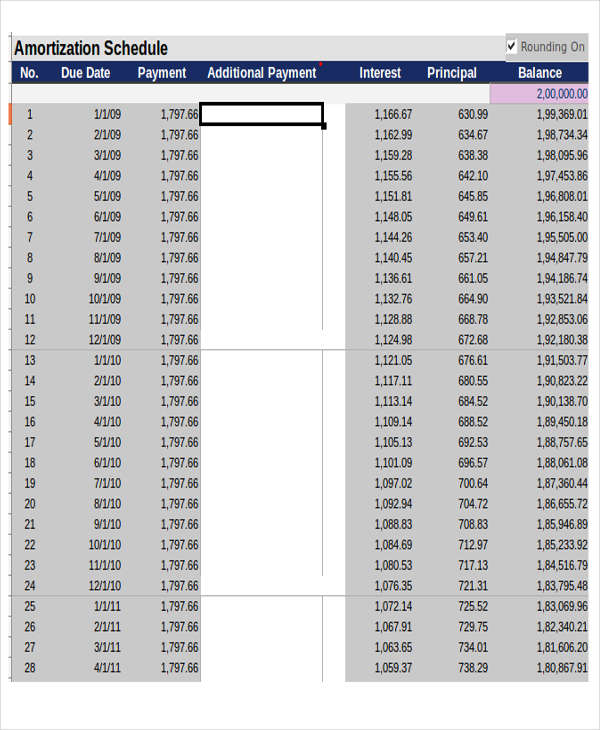

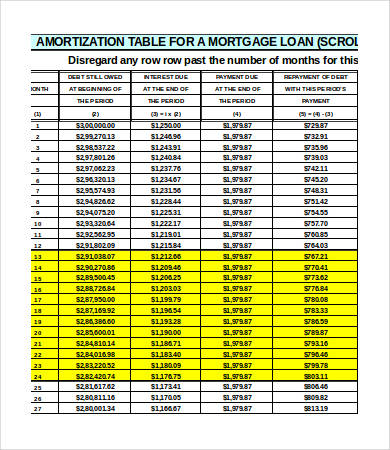

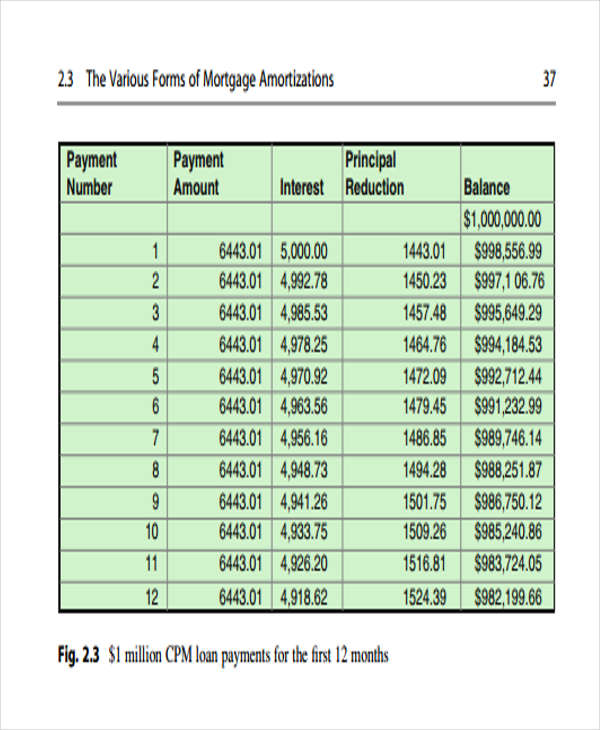

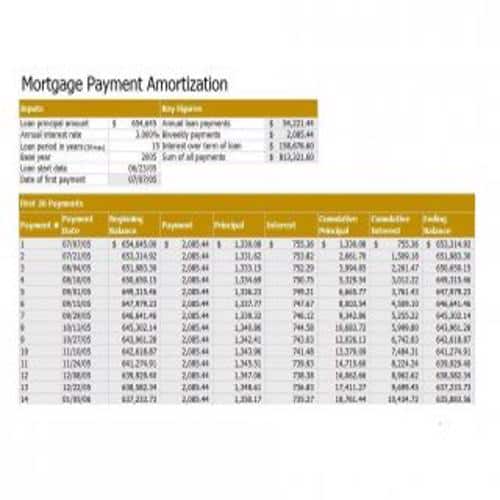

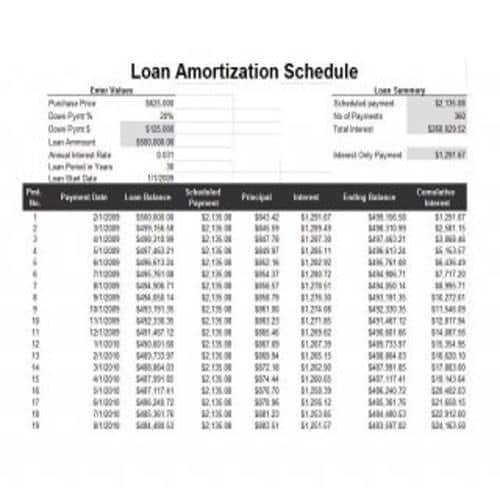

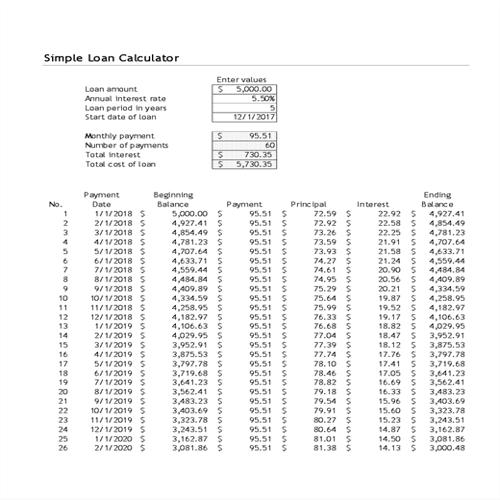

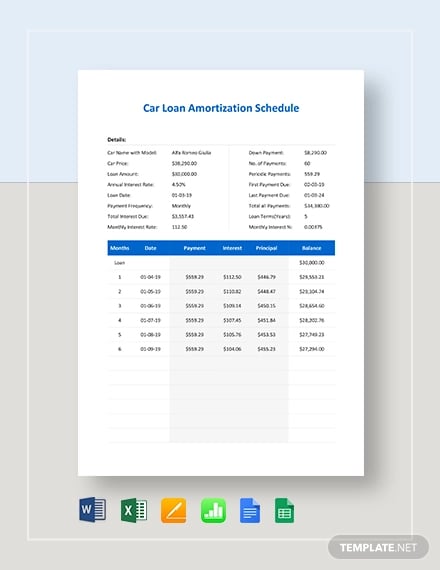

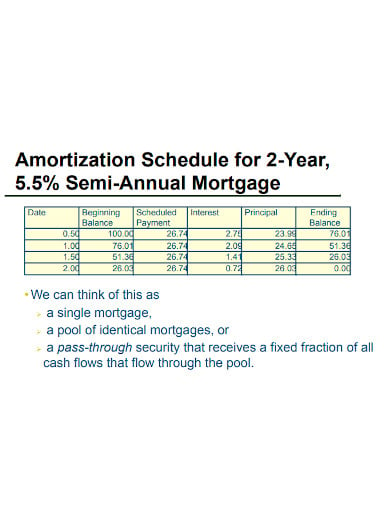

An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. Year 1 Month 1 Use Original Mortgage Amount Year 1 Month 2. Year 1 Month 4.

Rounded to two 2 decimal places This is the Monthly MIP. If a person. So if youre looking for a shorter mortgage a 15-year fixed-rate loan might work for you.

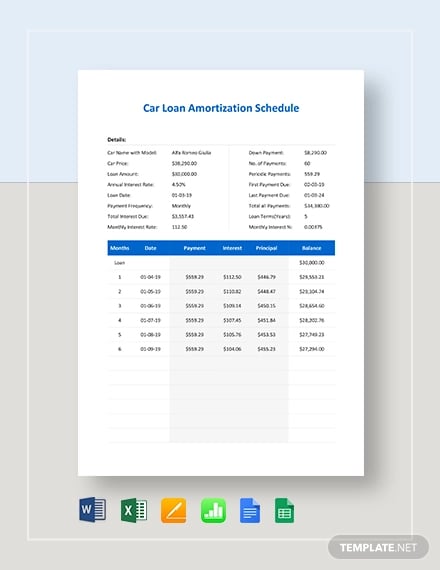

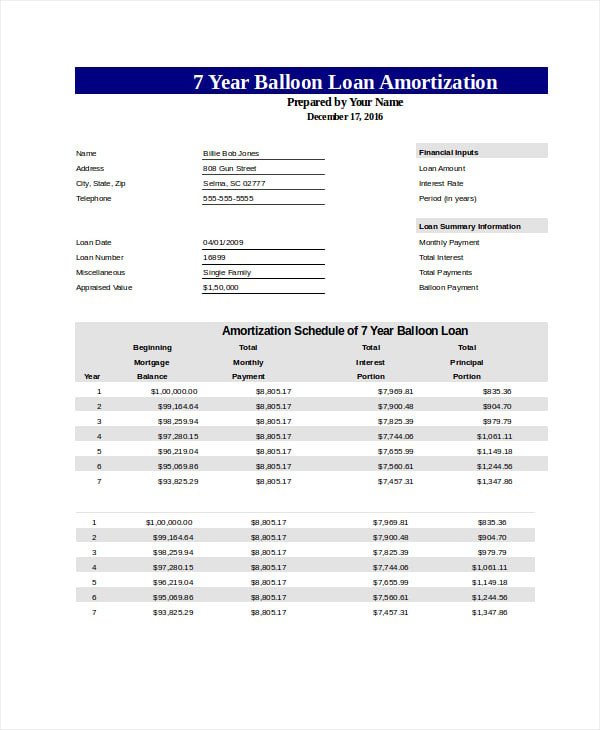

Current Mortgage and Refinance Rates. The balloon loan calculator comes with an amortization schedule that shows each of your monthly payment and the final balloon payment. Mortgage amortization schedule for year 6 2027.

Once every 12 months you can double your mortgage payment. Estimate your monthly loan repayments on a 600000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. Pre-pay up to 15 of your mortgage principal once every 12 months.

If your current rate on a 30-year fixed loan is 4000 would you like to see if you can get it lower. 15-year mortgage monthly household income 30-year mortgage monthly household income. Year 1 Month 3.

When the loan reaches this level the mortgage automatically converts into a fully amortizing mortgage which requires principal repayment. Payment 15 95483 65292 30191 Dec-1-2023 Payment 16 95483 65192 30291 Total 2023. Increase Your Mortgage Payment.

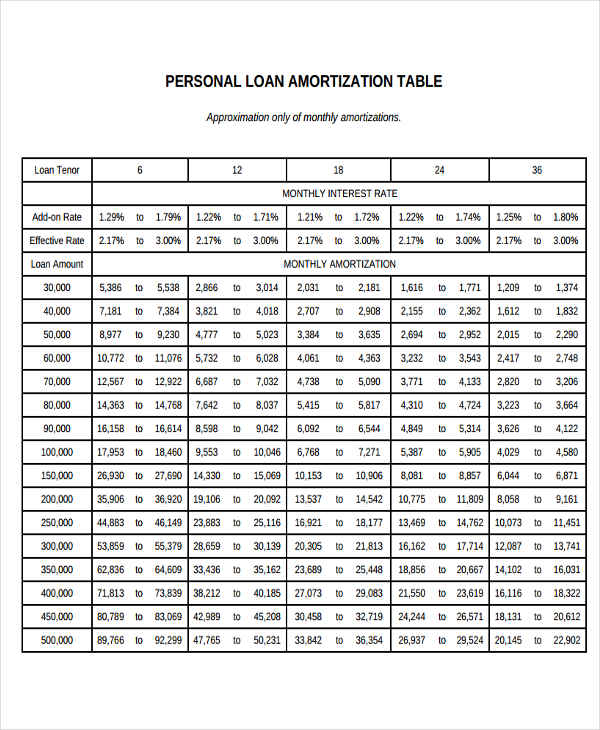

Including the Reverse Mortgage Comparison Loan Amortization Total Annual Loan Cost TALC Closing Cost Worksheet and the Good Faith Estimate GFE. A 100000 mortgage for a term of 36 months amortized over 300 months at 370 cmpd sa. For the fiscal year ending September 2011 loan volume.

15 of 29. See how much you can save with our intuitive refinance calculator. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest.

Estimate your monthly loan repayments on a 100000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. For GEMGPM compute current PI based on amortization plan. Balloon Mortgage Calculator With Amortization Schedule excel is used to calculate monthly payment for your balloon mortgage.

The average 51 adjustable-rate mortgage ARM rate is 4420 with an APR of 6230. People typically move homes or refinance about every 5 to 7 years. Build home equity much faster.

Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Associations rate surveys. Enter your current mortgage balance how much youd like to cash out if applicable and youll know almost instantaneously how much youll pay each month and how much youll spend over the life of the loan. The Best 20-Year Mortgage Rates for 2022.

Year Beginning balance. The Best 15-Year Mortgage Rates for 2022. With each subsequent payment you pay more toward your balance.

Divided by 12. With a TD 5-year mortgage you have access to the following features. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

29 Amortization Schedule Templates Free Premium Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

Amortization Tables 4 Free Word Excel Pdf Documents Download Free Premium Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

13 Amortization Schedule Templates Word Form Document

29 Amortization Schedule Templates Free Premium Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

29 Amortization Schedule Templates Free Premium Templates

Mailing List Templates 12 Free Docs Xlsx Pdf Formats Mailing List Template List Template Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

29 Amortization Schedule Templates Free Premium Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates